Strategies

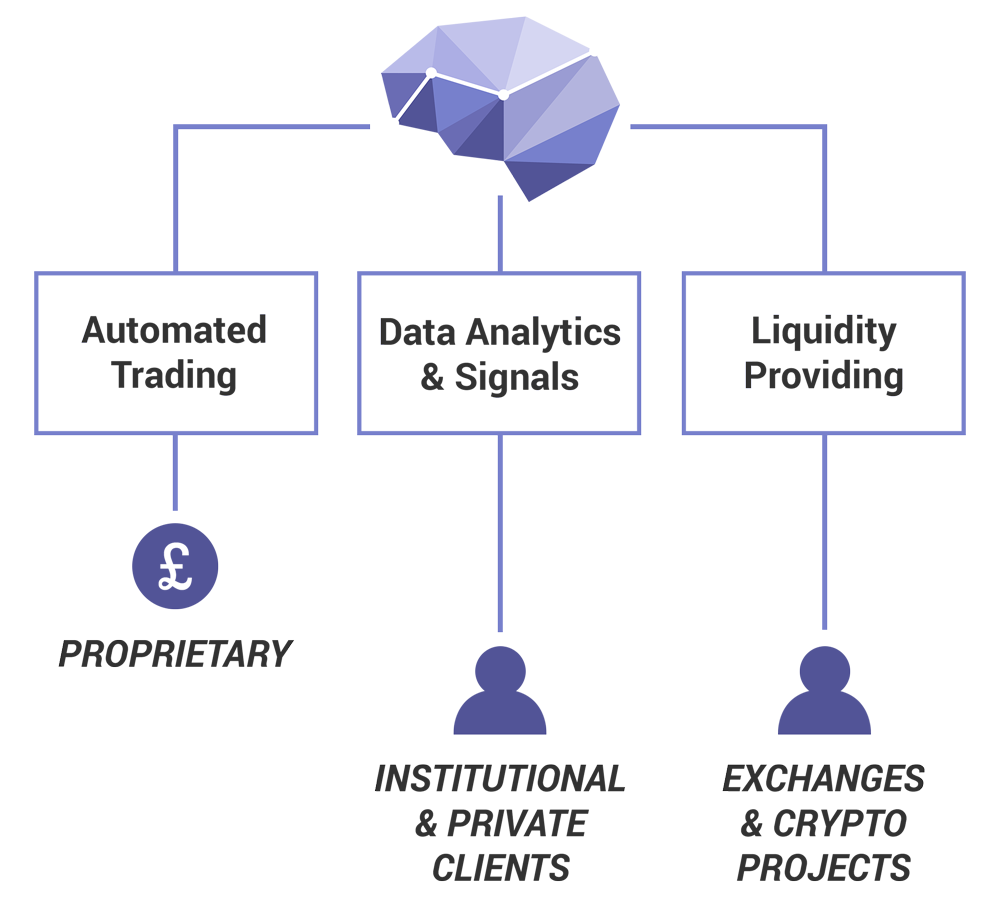

We actively employ asset management, market making, and automated trading strategies across a multitude of crypto markets.

Our in-house research aims to sustain the long-term development of the crypto ecosystem.

Find out more

Run an exchange? Our algorithmic strategies are designed to build depth in your order book and improve liquidity for your customers. Market making services help to facilitate a stable digital ecosystem on your exchange.

Market data is fed directly into our quantitative and Deep Learning models.

We use complex learning algorithms to detect trends and patterns in the data. These signals are used to plan and execute profitable trades.

Sentiment indicators help you forecast market movements corresponding with macro events.

Natural Language Processing powers our analytics to evaluate the context and sentiment of news articles and market participants on social networks.

Our financial models are optimised using evolutionary computation over many generations to source the most accurate representation of market conditions. As digital asset markets are subject to rapid change and unpredictability, our models are continually fed new data to evolve with the market and adapt to new trends.

Learn moreTRAIDER SOFTWARE was founded in 2018 as a quantitative research firm for cryptocurrency markets. An aptitude for AI and Machine Learning is realised in our automated trading software, and our cutting-edge research constitutes the backbone of the professional services we offer.

Why cryptos? We built our software to evolve with fast-paced financial markets, so our models are adept at handling the high volatility of the digital asset economy.

We help our clients navigate these markets with comprehensive analytics and precise forecasting.

The unprecedented growth of the industry is stressing the importance of automated systems to maintain the accessibility and efficiency of crypto platforms.

Our high frequency algorithms are perfectly suited for liquidity provision on low-volume markets, delivering a superior experience for the users of your exchange or token.

We actively employ asset management, market making, and automated trading strategies across a multitude of crypto markets.

Our in-house research aims to sustain the long-term development of the crypto ecosystem.

Find out more

We are always looking for people to inspire us - to be part of our growth and accelerate our innovation.

Contact us for information about opportunities.